unemployment insurance tax refund

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. But what this exclusion means is if you paid taxes on unemployment.

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Request a refund of the credit balance on our unemployment insurance tax account.

. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. 1 the IRS announced it had sent about 430000 tax refunds to taxpayers who overpaid taxes on their unemployment in 2020. Effects of the Unemployment Insurance Exclusion.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Otherwise youll receive a paper. Billion for tax year 2020.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. The size of the refund depends on several factors like income level and the.

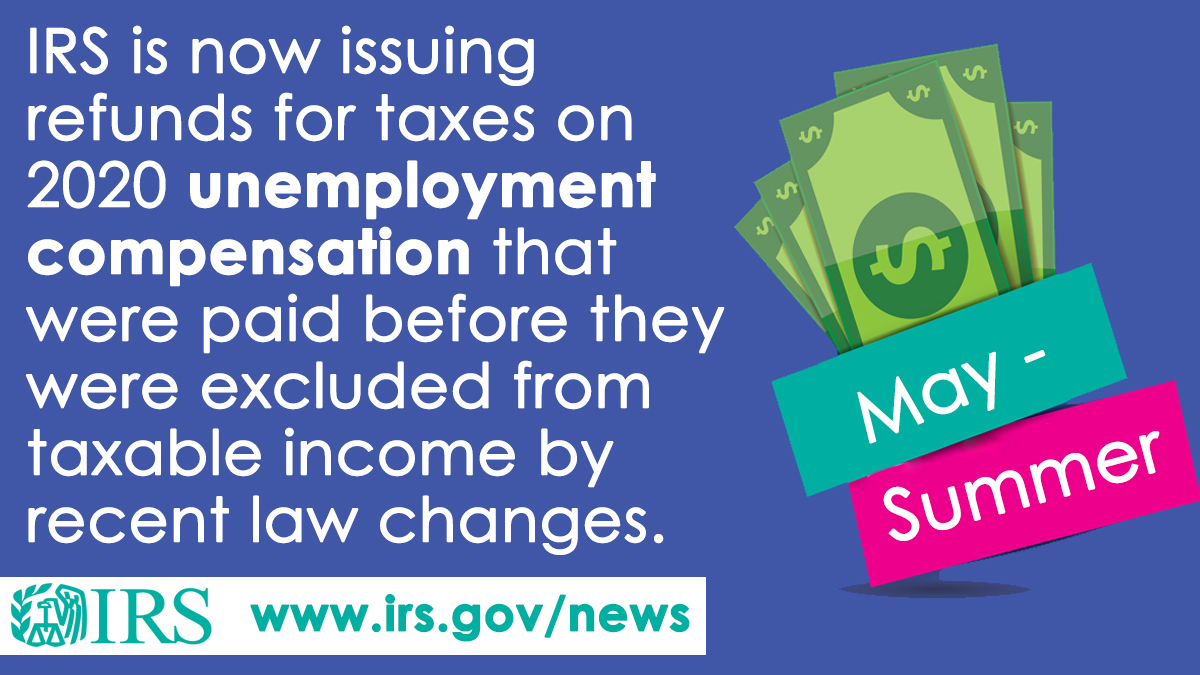

Unemployment tax refunds started to land in bank accounts in May and have continued throughout summer as the IRS processes the returns. Generally for a refund to be approved the money that caused the credit must have been paid at least 21 days. The latest stimulus includes a federal tax exemption for up to 10200 in unemployment benefits received in 2020.

IRS schedule for unemployment tax refunds. The amount the IRS has sent out to people as a jobless tax refund averages more than 1600. First-time users must register for Portal access.

The IRS has estimated that up to 13 million. Unemployment insurance tax refund 2021 Sunday March 27 2022 Edit The average refund for those who overpaid taxes on. Irs tax refund 2022 unemployment irs tax refund 2022 unemployment.

Tax season started Jan. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts. The federal tax code counts.

For some there will be no. You do not need to take any action if you file for unemployment and qualify for the adjustment. They dont need to file an amended tax return.

If the IRS has your banking information on file youll receive your refund via direct deposit. Under normal circumstances income from unemployment insurance is treated as income from a paycheck and subject to federal tax and state taxes where it applies. Chances are youve already paid your income taxes for 2020.

If you claim unemployment and qualify for. Heres how to claim it even if youve already filed. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May.

In the latest batch of refunds announced in November however the average was 1189. COVID Tax Tip 2021-46 April 8 2021. Yes they can take both state and federal refunds.

State Unemployment Insurance Compensation debts are now eligible for referral to Treasury Offset Program. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. It comes as some families.

And this tax season you wont be able to rely on a tax break for unemployment insurance either. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. UI Tax Refund and Overpayment Info.

Overpayment information can be viewed on the Employer Dashboard page of the Employer Portal. While taxes had been waived on up to 10200 received in unemployment for. The tax break is only for those who earned.

24 and runs through April 18. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. With the latest batch of payments on Nov.

According to the IRS the average refund is 1686. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year. 1 the IRS has now issued more than 117 million unemployment compensation refunds.

The average refund is up 376 to 3305 this year vs. For folks still waiting on the Internal. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144.

Taxes 2022 With Unemployment E Jurnal from ejurnalcoid.

Irs Unemployment Refunds What You Need To Know

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Compensation Are Unemployment Benefits Taxable Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Irs Sending Out Another 1 5 Million Tax Refunds To People Who Overpaid On Unemployment Benefits Cbs News

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

1099 G Unemployment Compensation 1099g

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits